https://www.consumerfinance.gov/owning-a-home/

![]()

![]()

![]()

![]()

![]()

MyRealEstateGeek.com Pros for CFPB

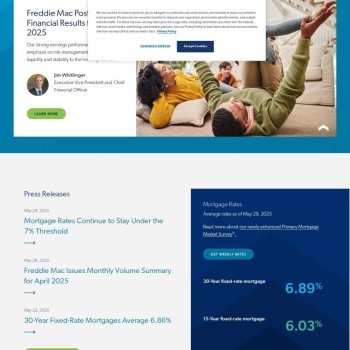

As a U.S. government website, it offers unbiased, ad-free information with no sales pitch.

Covers the mortgage journey from budgeting and loan types to closing disclosures.

Written in plain, accessible language ideal for first-time buyers.

Easy to use for planning and staying organized.

MyRealEstateGeek.com Cons for CFPB

The design is functional but not modern or highly engaging.

Doesn’t directly compare lenders or rates like commercial sites do.

... 8

... 9

... 10

... 14

... 7

... 5

... 9

... 14

... 10

... 4

... 11